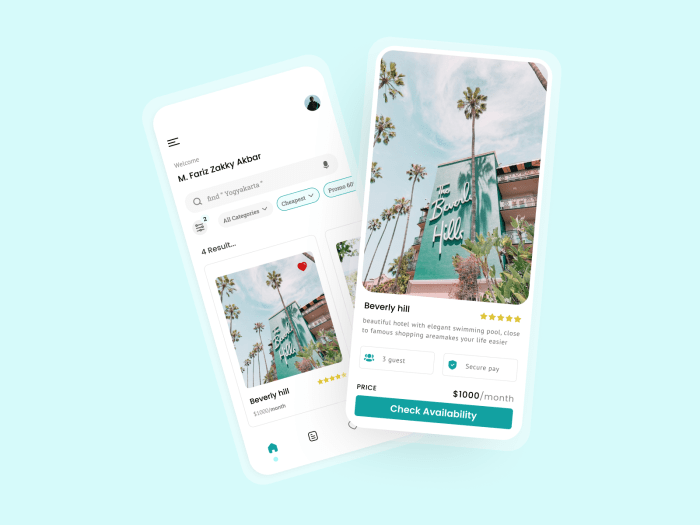

Embark on a mathematical adventure with our Finding an Apartment Math Quiz! This interactive tool empowers you to navigate the complexities of apartment hunting with confidence. From calculating affordability to evaluating lease terms, let’s crunch the numbers and find your perfect rental haven.

Our quiz is meticulously designed to provide a comprehensive understanding of the financial aspects of apartment hunting. Whether you’re a first-time renter or a seasoned pro, our questions will challenge your understanding and equip you with the knowledge to make informed decisions.

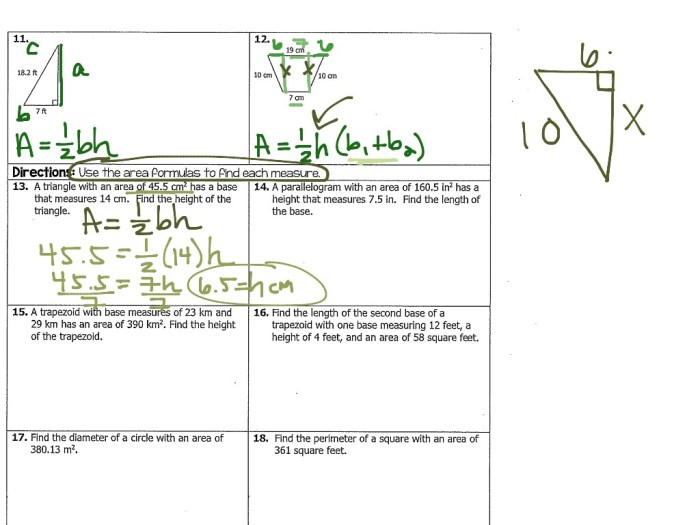

Types of Apartment Listings

Navigating the apartment rental market can be a daunting task, and understanding the different types of apartment listings available is crucial. Each type has its advantages and disadvantages, and choosing the right one can significantly impact your search experience.

Classified Ads

- Pros:Low cost, wide reach, potential for direct contact with landlords.

- Cons:Limited information, potential for scams, no screening process.

Online Listings

- Pros:Extensive listings, detailed information, user-friendly search filters.

- Cons:Competition can be high, may require paid subscriptions for premium features.

Agent Listings

- Pros:Professional guidance, access to exclusive listings, screening process.

- Cons:Higher costs, less control over the search process.

Understanding Apartment Terminology: Finding An Apartment Math Quiz

To navigate the apartment rental market, it’s crucial to understand the terminology used in apartment descriptions and floor plans. Let’s delve into a glossary of common terms to help you decode these listings effectively.

Square Footage

Square footage refers to the total floor area of an apartment, measured in square feet. It provides an indication of the size and space available within the unit.

Utilities

Utilities are services such as electricity, gas, water, and sometimes trash removal, which are often included in the rent or charged separately. Understanding which utilities are covered is essential for budgeting.

Lease

A lease is a legal contract that Artikels the terms of renting an apartment, including the rental amount, lease period, and responsibilities of both the landlord and tenant.

Interpreting Apartment Descriptions

Apartment descriptions typically include details about the unit’s size, amenities, and location. Pay attention to s that indicate specific features, such as “updated kitchen” or “in-unit laundry.”

Interpreting Floor Plans

Floor plans provide a visual representation of the apartment’s layout. They show the location of rooms, windows, and appliances. Studying floor plans helps you understand the flow of the space and visualize the apartment’s functionality.

Calculating Apartment Affordability

Determining whether an apartment is within your financial means is crucial before committing to a lease. This involves calculating the total monthly cost of the apartment, considering not only the rent but also other expenses such as utilities, parking, and renter’s insurance.

Factors Affecting Affordability

Beyond the monthly cost of the apartment, there are several factors that can impact its affordability for you personally. These include your income, existing debt obligations, and credit score. A higher income, lower debt, and a good credit score will make an apartment more affordable.

Calculating Monthly Cost

To calculate the total monthly cost of an apartment, start with the rent. Then, estimate the average monthly cost of utilities, such as electricity, gas, water, and internet. Additionally, factor in any other recurring expenses, such as parking fees or renter’s insurance.

Total Monthly Cost = Rent + Utilities + Other Expenses

Rule of Thumb

As a general rule of thumb, housing expenses should not exceed 30% of your gross income. This includes not only the monthly cost of the apartment but also any other housing-related expenses, such as mortgage payments or property taxes. By following this rule, you can ensure that you have enough money left over for other essential expenses and savings.

Example

Let’s say you have a gross monthly income of $5,000. According to the 30% rule, you should spend no more than $1,500 on housing expenses. If you find an apartment with a rent of $1,200, and estimate utilities to be $200 per month, then the total monthly cost would be $1,400. This would be considered affordable based on your income.

Scheduling Apartment Viewings

Scheduling apartment viewings in advance is crucial to secure your desired rental unit. By planning ahead, you can avoid last-minute hassles and ensure that you have ample time to thoroughly inspect the property.

Tips for Preparing for Apartment Viewings

-

-*Research the neighborhood

Familiarize yourself with the area’s amenities, safety record, and transportation options.

-*Make a list of must-haves

Determine your non-negotiable features, such as the number of bedrooms, bathrooms, and parking spaces.

-*Gather your documents

If you’re like me, you’ve probably spent countless hours trying to find the perfect apartment. It’s a math quiz in itself! But don’t worry, there are resources available to help. One such resource is texes special education ec 12 . With its comprehensive guide to apartment hunting, you’ll be able to find the perfect place in no time.

So, what are you waiting for? Head on over to the website and start your search today!

Bring identification, proof of income, and any other required documents to expedite the application process.

-*Dress professionally

First impressions matter, so dress appropriately for the viewing.

-*Be punctual

Arrive on time for the scheduled appointment to show respect for the landlord’s time.

Evaluating Apartment Features

Finding the perfect apartment involves more than just finding a roof over your head. It’s about finding a place that meets your unique needs and preferences. Evaluating apartment features is crucial in making an informed decision.

When assessing an apartment, consider the following key features:

Location

- Proximity to work, school, and amenities

- Safety and desirability of the neighborhood

- Access to public transportation

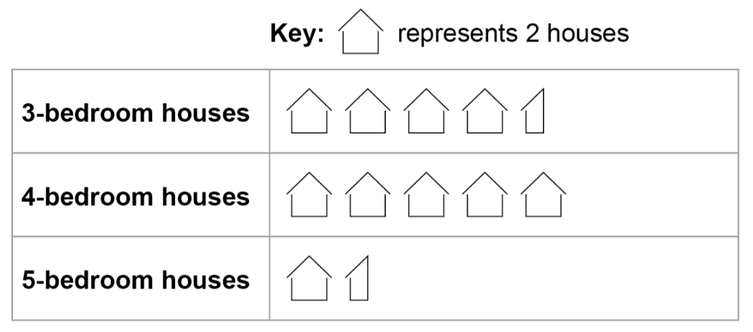

Size

- Number of bedrooms and bathrooms

- Square footage

- Layout and flow of the space

Amenities

- In-unit laundry

- Air conditioning

- Dishwasher

- Parking

- Community amenities (e.g., pool, gym)

Condition

- Overall cleanliness and maintenance

- Age and quality of appliances and fixtures

- Any signs of damage or repairs needed

Prioritizing these features depends on your individual needs. For example, if you have a long commute, proximity to work may be a top priority. If you value privacy, a quiet neighborhood might be more important. Ultimately, the best apartment for you is the one that aligns with your specific criteria.

Negotiating Apartment Lease Terms

Negotiating the terms of your apartment lease is an important step in securing your new home. By understanding the typical terms of a lease and knowing how to negotiate, you can get the best possible deal.

Rent

The rent is the amount of money you will pay each month to live in the apartment. It is important to factor in the rent when budgeting for your new home. You should also consider the length of the lease term, as this will affect the total amount of rent you will pay.

Security Deposit

The security deposit is a sum of money that you will pay to the landlord when you sign the lease. This deposit is used to cover any damages to the apartment that occur during your tenancy. The security deposit is typically refundable at the end of your lease term, provided that you leave the apartment in good condition.

Lease Length

The lease length is the amount of time that you will be obligated to live in the apartment. Lease terms can range from six months to two years or more. It is important to choose a lease term that fits your needs and budget.

Tips for Negotiating Favorable Lease Terms

- Be prepared to negotiate. Before you start negotiating, do your research and know what you are willing to pay.

- Be willing to compromise. You may not be able to get everything you want, but you should be able to reach a compromise that works for both you and the landlord.

- Be polite and respectful. Even if you are negotiating hard, it is important to be polite and respectful to the landlord.

Moving into an Apartment

Moving into an apartment marks a significant milestone, but it can also be a daunting task. By following a well-organized plan and considering essential factors, you can ensure a smooth and stress-free transition.

Packing

Packing efficiently is crucial to prevent chaos and damage during the move. Start by decluttering and discarding anything you don’t need. Pack items room by room, using sturdy boxes and packing materials. Label boxes clearly with their contents and destination room to facilitate unpacking.

Transportation

Determine the transportation method that best suits your needs and budget. If you have a large amount of furniture and belongings, consider hiring a professional moving company. Alternatively, you can rent a truck or van and enlist the help of friends or family.

Utilities Setup, Finding an apartment math quiz

Contact utility providers (electricity, gas, water, internet) in advance to schedule connection dates. Provide your new address and account information to ensure uninterrupted service on move-in day.

Expert Answers

What types of apartment listings are available?

Apartment listings come in various forms, including classified ads in newspapers or online, listings on real estate websites, and agent listings provided by professional real estate agents.

How can I calculate the monthly cost of an apartment?

To calculate the monthly cost, consider the rent, utilities such as electricity, water, and gas, as well as any additional fees or expenses associated with the apartment.

What factors can affect apartment affordability?

Affordability is influenced by factors such as your income, debt obligations, and credit score. A higher income and lower debt-to-income ratio typically enhance affordability.