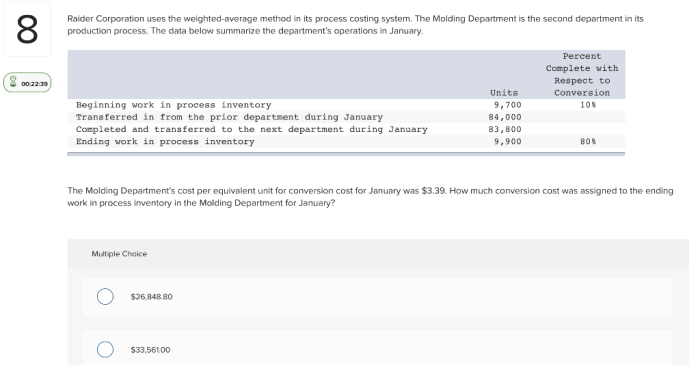

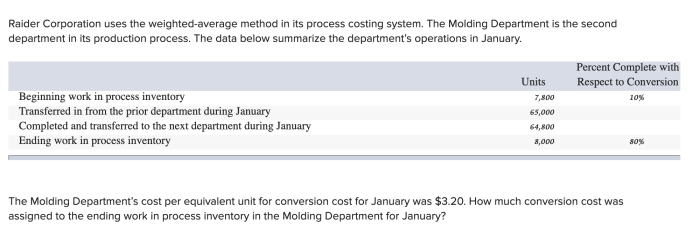

Raider corporation uses the weighted-average – Raider Corporation employs the weighted-average inventory costing method, a technique that calculates an average cost per unit based on the costs of all units available for sale during a period. This method provides a more accurate representation of inventory value than other costing methods, such as FIFO or LIFO, and is particularly advantageous for companies with high inventory turnover.

Raider Corporation’s implementation of the weighted-average method involves tracking the quantity and cost of each inventory item on hand. When new inventory is purchased, its cost is added to the total inventory cost, and the average cost per unit is recalculated.

This average cost is then used to determine the cost of goods sold and the value of ending inventory.

Weighted-Average Method:

The weighted-average method is an inventory costing method that assigns a single average cost to all units of inventory, regardless of when they were purchased. This method is used to simplify inventory accounting and to provide a more accurate estimate of the cost of goods sold.

To calculate the weighted-average cost, the total cost of goods available for sale is divided by the total number of units available for sale. This average cost is then assigned to each unit of inventory.

For example, if a company purchases 100 units of inventory at a cost of $10 per unit and then purchases another 100 units at a cost of $12 per unit, the weighted-average cost per unit would be $11. This cost would be assigned to all 200 units of inventory.

Raider Corporation’s Inventory:

Raider Corporation uses the weighted-average method to cost its inventory. This method is consistent with the company’s policy of valuing inventory at the lower of cost or market.

Raider Corporation maintains a perpetual inventory system, which means that the company tracks the quantity and cost of inventory on hand at all times. This system allows the company to calculate the weighted-average cost of inventory as new inventory is purchased and as old inventory is sold.

Impact on Financial Statements:

The weighted-average method has a significant impact on Raider Corporation’s financial statements. The method affects the cost of goods sold and the inventory valuation.

The cost of goods sold is the cost of the inventory that is sold during a period. The weighted-average method assigns a single average cost to all units of inventory, so the cost of goods sold is simply the average cost multiplied by the number of units sold.

The inventory valuation is the value of the inventory on hand at the end of a period. The weighted-average method assigns a single average cost to all units of inventory, so the inventory valuation is simply the average cost multiplied by the number of units on hand.

Advantages and Disadvantages:

The weighted-average method has several advantages. The method is simple to use and it provides a more accurate estimate of the cost of goods sold than other inventory costing methods, such as the FIFO method or the LIFO method.

However, the weighted-average method also has some disadvantages. The method can result in inventory valuations that are not always consistent with the actual market value of the inventory. Additionally, the method can be difficult to use when there are multiple units of inventory with different costs.

Alternative Inventory Costing Methods:: Raider Corporation Uses The Weighted-average

There are several alternative inventory costing methods that can be used by companies. The most common alternative methods are the FIFO method and the LIFO method.

The FIFO method (first-in, first-out) assumes that the first units of inventory purchased are the first units sold. This method results in inventory valuations that are consistent with the actual market value of the inventory.

The LIFO method (last-in, first-out) assumes that the last units of inventory purchased are the first units sold. This method results in inventory valuations that are not always consistent with the actual market value of the inventory.

FAQ Guide

What are the advantages of using the weighted-average inventory costing method?

The weighted-average inventory costing method provides several advantages, including improved accuracy in inventory valuation, reduced risk of over or under-costing, and simplified inventory management.

How does the weighted-average inventory costing method affect the cost of goods sold?

The weighted-average inventory costing method affects the cost of goods sold by providing a more accurate representation of the average cost of inventory items sold during a period.

What are the differences between the weighted-average inventory costing method and other methods, such as FIFO and LIFO?

The weighted-average inventory costing method differs from other methods, such as FIFO and LIFO, in the way that it calculates the average cost of inventory items. The weighted-average method considers the cost of all units available for sale during a period, while FIFO assumes that the oldest units are sold first and LIFO assumes that the newest units are sold first.